Inheritance Tax Planning

Are you liable to Inheritance Tax?

The first £325,000 (2009 / 2010) of an individual’s estate is taxed at 0% and is therefore not liable to Inheritance Tax. For married couples and registered civil partners it is currently £650,000, if the full allowance is passed to the surviving spouse. Anything in excess of this amount is taxed at 40% on death.

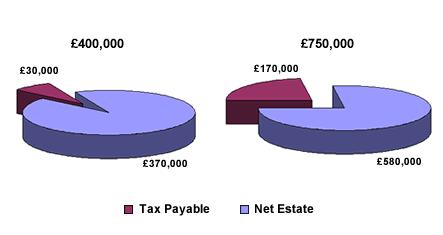

The charts below show not only how easily the HM Revenue & Customs can become the single largest beneficiary of your estate, but also that the larger your estate the higher the percentage lost.

The above illustrates an individual’s estate.

The following courses of action can mitigate Inheritance Tax:

Ensure your will is written and planned correctly to save the maximum amount of tax.

Transfer assets through the sensible use of lifetime gifts.

Create a tax-efficient fund to enable the beneficiaries of an estate to meet the tax liability without disturbing the family wealth. Under current IHT legislation, pensions can play a considerable role in estate planning.

Death benefits under approved pension plans are broadly exempt from IHT although a liability to periodic and exit charges can arise in a limited number of circumstances.

Although pension death benefits are broadly exempt from IHT, if they are passed to your survivor they will form part of their estate. Gateway Financial Advisers can advise on the best solutions which allow your survivor access to your death benefits without them forming part of their estate.

For further information, please contact us to discuss your personal situation.

The information on this website is based on our interpretation of the law and HMRC practice as at April 2009. Taxation legislation and HMRC practice may be subject to unforeseen changes in the future.

Wills and some areas of Inheritance Tax Planning are not regulated by the Financial Services Authority.